- The Taiwan textile industry, supported by forward-looking government policies, successfully achieved a transition from a labor-intensive production to an innovation-based one, to counter competition from developing countries.

- The Taiwan textile industry now covers 70% of the global market for functional fabrics. Yet this leading role is little known to the big public when buying their favorite sports apparel.

Despite never having qualified for a FIFA World Cup, Taiwan has won the majority of the locker rooms since 2010. Indeed, most of the major sports clothing brands, such as Nike and Adidas, are using Taiwanese functional textiles. It has been estimated that in recent years Taiwan has covered 70% of the global market for functional fabrics, which in turn accounts for 10% of the total textile market. Little known to the public, however, is how this Far East Island reached such a prominent position. Similar to its dominant yet rather unrenowned leadership position in semiconductor manufacturing, Taiwan’s functional textile industry remains satisfied with leading behind the curtains.

A brief history class

The Taiwan textile industry started developing back in the 1950s when raw materials, mainly cotton, were imported for yarn spinning. With the help of US aid and efficient government policies such as tax incentives, protective measures, and the stimulation of weaving services, the textile industry grew rapidly. Soon, the production exceeded the local demand and textiles started being exported massively. Later, with the development of the local petrochemical industry, artificial fiber and finished goods became core products of the Taiwanese textile industry. Throughout Taiwan’s extraordinary economic growth during 1950-1990s, the textile sector was one of the three most important industries that contributed to the country’s phenomenal economic expansion. Even today, it remains one of Taiwan’s strategically important export sectors (3rd largest trade surplus) and enjoys a full and integrated product chain, from fiber, yarn, fabrics, dyeing, and finishing to apparel and accessories. As of 2021, there are around 4,430 textiles and clothing firms in Taiwan, employing about 163,000 people.

However, in the late 1980s, Taiwan’s textile industry encountered major challenges and saw its leading position endangered. Rising labor costs, the opening of China to the capitalist world economy, and the popularisation of Southeast Asian countries as low-cost production locations all proved detrimental to Taiwan’s role as a labor-intensive textile manufacturer. In order to overcome these hardships, the Taiwan textile industry decided to relocate most of its labor-intensive production to these new emerging markets. The segments of the textile and garment value-added chain that remained in Taiwan in the late 1980s were inspired by the Japanese textile industry and began to focus extensively on technology and new product development. With the help of innovation-focused government policy, the Taiwan textile industry increasingly became capital and technology oriented. Innovation became synonymous with competitiveness and R&D concentrated on cutting-edge textiles, amongst which were the so-called functional textiles.

Functional textiles

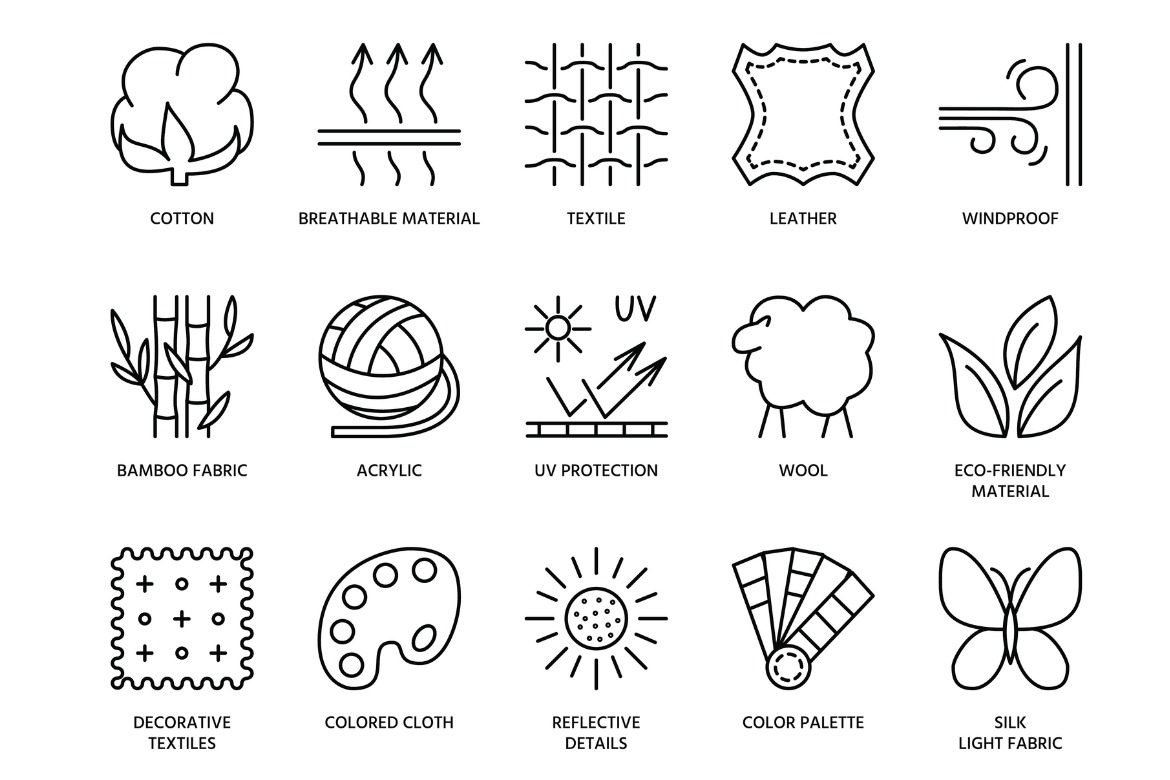

Functional textiles are fabrics with integrated functions. They can have one or multiple functionalities, for example, temperature and humidity control, fire resistance, wrinkle-freeness, moisture absorption, or electromagnetic shielding. They are also known as technical textiles. However, the Taiwan Textile Federation (TTF) popularised them under the name of functional textiles and, in 2001, established an internationally recognised certification process in order to test and guarantee the quality of their functional textiles.

Forward-looking government policy

Although the Taiwanese textile industry has successfully tackled the numerous stumbling blocks it encountered, it could not have been done without the help of an effective government policy. The Taiwanese authorities realised the importance and the strongly export-oriented nature of their textile industry quite early on. Therefore, they took a series of measures to counter the increasing competitive pressure from developing countries and to guarantee the prosperous development of their textile industry. First, they promoted an investment-friendly environment by offering various financial incentives. Secondly, they strongly supported small and medium-sized enterprises through preferential loans, access to raw materials, and a progressive shift towards capital-intensive manufacturing. SMEs are now the backbone of the Taiwan textile industry. Lastly, to encourage technological upgrading and innovation, the Ministry of Economic Affairs introduced several measures to help textile firms.

For this purpose, it set up two important institutions. The first is the Taiwan Textile Federation, which was initially established to take charge of quota distribution. Nowadays, it has broadened its scope and includes services such as market development, organization of trade shows, analysis of market information, and the certification of Taiwan Functional Textiles. The second institution – The Taiwan Textile Research Institute (TTRI) – handles long-term growth and development planning. Among its services, the TTRI provides R&D help, technical guidance and talent training, testing and certification services, as well as industrial services for the less developed Taiwanese counties. In recent years, the Taiwanese authorities and textile industry have started strongly promoting eco-friendly and socially responsible manufacturing, making it a Taiwanese trademark.

A bright future

Although the COVID-19 pandemic has negatively affected supply chains around the world and induced a raw material shortage, it has also created a sudden increase in demand for medical and safety gear such as masks. To fill this gap, the Taiwan textile industry increased its daily production of safety masks from 1.88 million to 20 million a day in only three months. This perfectly illustrates the prompt reaction and adaptability that is the forte of the Taiwan textile industry.

Knowing that it cannot compete in the labor-intensive segment anymore, the Taiwanese textile industry is pushing its innovation while fostering sustainable and socially responsible production. Taiwan might have reached its plateau of textile firms, yet its profitability should continuously increase thanks to the forward-thinking business culture and the opportunities offered by overseas manufacturing. One particularly interesting emerging segment of the Taiwan textile industry is smart textile, which mixes classic textiles with new technology. Its potential is endless, but it still needs to mature.

Despite Taiwan’s remarkable achievements in the textile industry, few western consumers realize its role in the production of their favorite apparel. When one buys a hiking jacket or a running shirt, the brand on the outside signals the product’s western heritage and the label inside indicates the country of production; these days that is likely to be Southeast Asia. The name Taiwan, however, fails to appear at all, despite the fact that the product’s functional material and much of the production innovation originates from the East Asian Island. According to TTF, Taiwanese suppliers are not bothered by this lack of publicity and remain content to stay behind the scenes as long as the big brands continue to order their textiles. One is left to wonder whether such a policy might prove to be an obstacle in the future or an advantage.

NO COMMENT