- Switzerland does try to focus on high-value technologies and has created an ecosystem to support them every step of the way. The value generated continues to percolate to the local economy.

- The challenge for the Indian entrepreneurship ecosystem is to focus on capturing and scaling value while creating and sustaining the local market and recognising it as an inclusive rather than an extractive resource.

Entrepreneurship is increasingly recognised globally as a way to drive innovation, highly skilled employment generation and as a source of sustainable competitive advantage. Both Switzerland and India have seen significant growth in startups over the past decade. And this may be just the beginning.

However, there are some very significant differences between entrepreneurship in India and Switzerland. Most startups in Switzerland are based on technology excellence. This is due to two reasons. One is that there are many technology universities that do ground-breaking research and have done so for well over a century. The Federal Institute of Technology, Zurich (or ETH Zurich) is one, which was also the alma mater of Einstein over 120 years ago. But this is also because being a small ecosystem, there isn’t enough opportunity to scale for startups that want to become platforms like Amazon, Twitter or Zomato. Due to this, technology startups are far more likely to get funded. Over time, it’s been observed that the survival rate of technology startups is very high, and over 90% of them are still around five years after being founded. This compares with a survival rate of less than 5% for platform startups or service-based startups.

The challenge is that when an economy opens, the first businesses that enter are not the infrastructure companies but for companies like McDonald’s and Coca Cola. This is because they are easy to roll out without capital investment. This is most often the kind of startup seen in India: most startups are subsidiaries of foreign companies, and almost all of them are platform startups. There are two risks with platform startups. One is the low success rate. The second and more significant one is that if this is foreign-owned, the user information flows out and is monetised outside the country. This is very different from China, which consciously blocked companies like Facebook and Google and made life so difficult for Uber to sell to Chinese competitor DiDi Chuxing. Over time, China has also begun focussing on supporting technology startups due to the more sustainable competitive advantage.

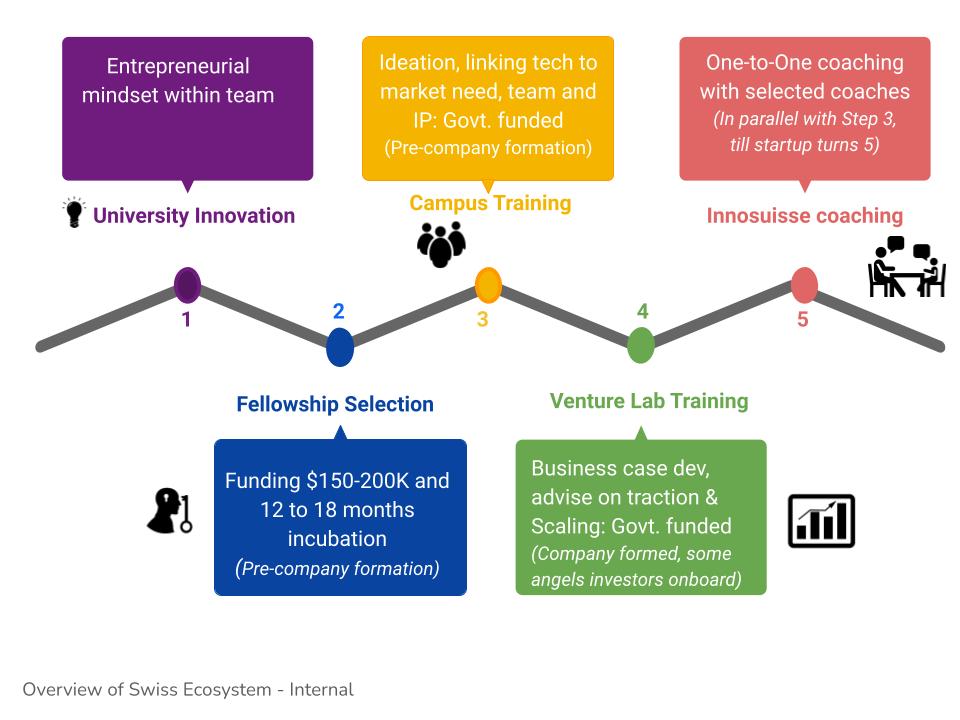

Switzerland has recognised that to the extent possible, and startups should continue to be locally owned with headquarters in Switzerland. The value generated continues to percolate to the local economy. However, it’s not possible to coerce startups to do this in a free and open society. Switzerland does try to focus on high-value technologies and has created an ecosystem to support them every step of the way. Since it is clear that technology-driven startups can protect the value they create via intellectual property, the focus is then to identify high-value industrial impact. The ecosystem supports and incubates them and provides initial funding. Universities often have their incubators, which provide funding and initial advisory support. Government-funded training programs follow this. Startup Campus is the first such program for early-stage entrepreneurs or those who haven’t crystallised their idea and are yet to have a team. This runs for 13 weeks with weekly sessions, each addressing different elements necessary to convert the idea into a business case. Venture Lab is the following program for those who already have a clear idea and have already established the company in many cases. This tends to be a five-day program, spread over a month.

Switzerland has recognised that to the extent possible, and startups should continue to be locally owned with headquarters in Switzerland. The value generated continues to percolate to the local economy. However, it’s not possible to coerce startups to do this in a free and open society. Switzerland does try to focus on high-value technologies and has created an ecosystem to support them every step of the way. Since it is clear that technology-driven startups can protect the value they create via intellectual property, the focus is then to identify high-value industrial impact. The ecosystem supports and incubates them and provides initial funding. Universities often have their incubators, which provide funding and initial advisory support. Government-funded training programs follow this. Startup Campus is the first such program for early-stage entrepreneurs or those who haven’t crystallised their idea and are yet to have a team. This runs for 13 weeks with weekly sessions, each addressing different elements necessary to convert the idea into a business case. Venture Lab is the following program for those who already have a clear idea and have already established the company in many cases. This tends to be a five-day program, spread over a month.

There are a number of angel investor clubs addressing seed funding for specific verticals. VC funds, often backed by local angel investors, provide A round funding. More importantly, the ecosystem involves local industries that become initial customers. This helps keep the innovative startups in Switzerland, with a view that the next Nestle or Novartis that is created continues to be headquartered in Switzerland, creating thousands of jobs and helping drive the economy.

Beyond this, the real currency is not only innovative technologies but user data. Towards this end, Swiss startups like MindMaze and Bright Peak Therapeutics, both unicorn startups founded by Indians researchers, recognise that the true sustainable value is personalised data. This is yet to be recognised by Indian startups. Therein lies the risk, since by letting Silicon Valley startups transfer and own personal data of Indian customers, particularly health data, India runs the risk of replaying the outflow of raw materials and importing finished goods, first done by East India Company.

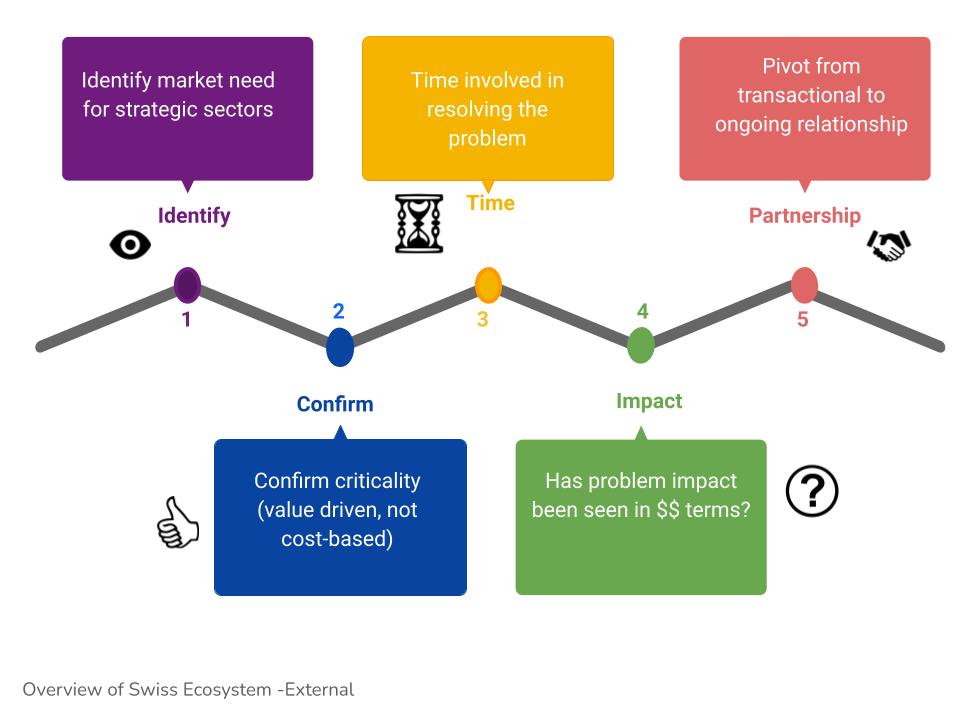

Going forward, the challenge for the Indian entrepreneurship ecosystem is to focus on capturing and scaling value while creating and sustaining the local market and recognising it as an inclusive rather than an extractive resource. This is because the most sustainable competitive advantage is customer loyalty based on mutual benefit. Emerging Indian investors like Sahas Partners can help startups to capture, protect, scale, sustain and monetise this value.

The real opportunity for the Indian startup ecosystem is to recognise that Indian unicorns, owned and run by Indians, are not an anomaly but the need of the hour. The truly visionary startups will look beyond the transactional opportunities of value creation like online food platforms and consider the multi-generational impact on health tracking and infrastructure. And this is how they will build tomorrow.

NO COMMENT