- Taiwanese companies such as Hope English, LiveABC, and MyET make use of artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) to improve the efficiency and experience of online language learning.

- The government support has enabled EdTech businesses to provide fast and reliable after-sales service. This has established the island as a trustworthy and dynamic partner and, thus, gives Taiwanese EdTech companies an edge over their foreign competitors.

All over the world, the COVID-19 pandemic has had a considerable impact on education and the way we learn. Hard lockdowns have meant that classrooms and workplaces move from the physical to the virtual. This global health crisis has, thus, significantly accelerated the growth of the global Education Technology (EdTech) industry.

However, Taiwan’s EdTech industry came of age long before the pandemic. With a mature high-tech sector, the desire for education, and supportive government policies – Taiwan has provided the ideal environment for the industry to develop and flourish. The past, present and future of EdTech in Taiwan makes for a great study on EdTech for any potential collaborator.

History

In the 1970s, the global energy crisis and industrial countries’ trade protectionism pushed Taiwan from a traditional industrial model to a more technology-intensive one. The government subsequently set up the Institute for Information Industry (III), a government-funded think tank. Today, the III’s focus lies on promoting information communication technology (ICT) innovation and applications in Taiwan and assisting in developing the digital economy.

EdTech is a sector that comes under this umbrella. Through the “METAEDU” programme, the III aims to “lead the education technology industry into the global arena” and establish Taiwan’s EdTech industry as an international brand.

The III pursues these goals through various means. It fosters and attracts ICT talent and conducts in-depth market research programmes focusing on a prevailing trend in the industry, such as digitalisation in education, smart campus transformation or STEAM education. The III upgrades these programmes every four years. Additionally, it liaises between domestic EdTech companies offering complementary hardware and software products and between the companies and domestic or international customers to aid market integration and expansion. To that end, the III also organises annual summits, forums, and exhibitions for key Edtech leaders, government officials, researchers, educators, and investors to gain industry insights and trends.

EdTech and the pandemic

There is no doubt that Taiwan’s EdTech industry has benefited from the ongoing COVID-19 pandemic. Certain trends in EdTech that emerged before the pandemic received a boost and continue to grow. For mature and independent learners, self-learning, acquiring skills through video tutorials, and online language learning are increasingly in demand. Taiwanese EdTech businesses know how to cater to those needs. Companies such as Hope English 希平方, LiveABC, and MyET make use of artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) to improve the efficiency and experience of online language learning.

The start-up Hahow (meaning “school” in Taiwanese) is “the world’s first crowdfunding platform for online courses.” Anyone with skills and knowledge to share can offer a course on the platform. What sets Hahow apart is that the course is only filmed once a certain number of people are willing to preorder it. This guarantees a minimum income to the instructor before filming and helps maintain high-quality videos. This ensures that a course meets the market needs before being produced.

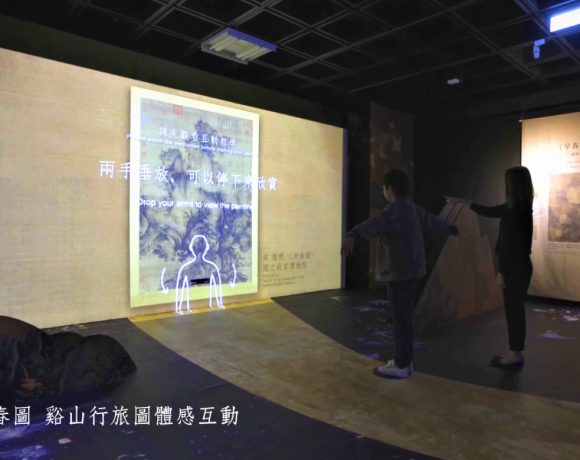

For school-aged learners, Taiwanese EdTech businesses also have a lot to offer. Through gamification, AR and VR, robots, and 3D or interactive animations, companies such as JTQC Digital Education Co., Ltd., Hamastar, Actura, Gigo, AI Digital Co., Ltd ., and many more introduce fun and immersive learning in the classroom.

According to the METAEDU report 2021, the Taiwan EdTech market total output value reached USD 16.4 billion in 2021, a growth of 220.9% compared to the year before.

The growth was mainly driven by the high demand for teaching hardware as a result of lockdowns and remote learning. Hardware accounted for 84.9% of the total output value and saw an annual growth of 354.5% in 2021. Software systems were also doing well, with an annual growth rate of 79.6%, reaching an output value of USD 1.13 billion. Compared to 2020, the only decline – a 3.8% reduction – was seen in teaching content. With an output value of USD 1.37 billion, it made up 8.3% of the overall.

The overseas market value accounted for nearly three-quarters of the overall market value in 2021. It increased by 410.2% to reach USD 12.18 billion, a historical high that was reached due to the urgent demand for hardware products.

Strengths and challenges

Taiwan’s EdTech industry is doing very well overseas – and not just since the pandemic. A combination of factors has helped the industry flourish. First, Taiwan has very mature technology and manufacturing industries that foster talent. Unsurprisingly, many EdTech companies were and are founded by corporate alumni of big corporations in these industries.

Next, EdTech companies benefit from government policies and support. According to Massarow Shen, Manager of International Cooperation at III, there are a lot of EdTech startups in Taiwan. Most are restricted by tight budgets and lack staff experienced in dealing with domestic and international customers – especially customers that require a lot of complex administrative work for sales, such as public schools. Here the III provides assistance to small and mid-sized businesses, so they do not miss out on these business opportunities.

Lastly, Shen points out that the III’s support also enables EdTech businesses to provide fast and reliable after-sales service. This has established Taiwan as a trustworthy and dynamic partner and, thus, gives Taiwanese EdTech companies an edge over their foreign competitors.

Taiwanese EdTech’s innovative capabilities have also been acknowledged by HolonIQ, a leading global impact intelligence platform. The platform, which normally reports on regions such as the Nordic-Baltic, Africa, or Southeast Asia, dedicated a whole segment to Taiwan (see 2021 Taiwan EdTech 50).

Nonetheless, it isn’t all smooth sailing for the Taiwanese EdTech industry. For one, there is steep competition for talent in the technology sector, making attracting and keeping talent a constant challenge. For another, according to Shen, there is an overreliance on the mainland Chinese market. This is partly because of the shared language, which greatly facilitates communication. To compete globally, companies will have to strengthen their English proficiency significantly. Whether ambitious government plans to make the population bilingual by 2030 will be fruitful remains to be seen.

Outlook

While the pandemic is not over yet, the time of hard lockdowns with school closures and working from home is becoming a thing of the past. So what will the future of Taiwanese EdTech be?

Industry experts agree that remote learning in a fully digital classroom is unlikely to be our future, but neither are we going back to the way we received education before. As Joey Yao from the III predicts, a hybrid education model will likely be the future. Learning behaviour has changed due to the pandemic, and investments in teaching hardware and software offer new possibilities for educators and students alike.

Furthermore, EdTech can also address some of the challenges the education sector is facing, such as a lack of qualified teachers in certain subjects. One such example is the award-winning CodingBar. Coding is becoming an increasingly popular and necessary skill around the globe, but there aren’t enough instructors. CodingBar offers a program with four levels (creator, explorer, innovator, expert) for students ages 10 to 17 to learn to code. The only prerequisite is having a computer with internet access. It is already successfully used in over 60 schools in Taiwan as well as overseas.

EdTech’s future looks promising – and Taiwanese EdTech companies are likely to play an important part in it.

NO COMMENT