- Large and small Korean companies are under pressure to transition to cleaner, greener businesses as they look to deliver relevant products and services that map to modern consumer lifestyles both at home and globally.

- There are technology and human resources in Korea for tackling sustainability challenges. Now it is about the timing of the demand – whether any foreign company is ready for a specific solution when Korean conglomerates need a quick adaptation.

- The Korean government established nineteen local Centers of Creative Economy and Innovation in 2014, from which the Korean start-up ecosystem often grows. Since the centres are paired with conglomerates and backed by local government obligations, this can be a channel for accelerated commercialisation in the Korean market for foreign companies’ partnerships with Korea.

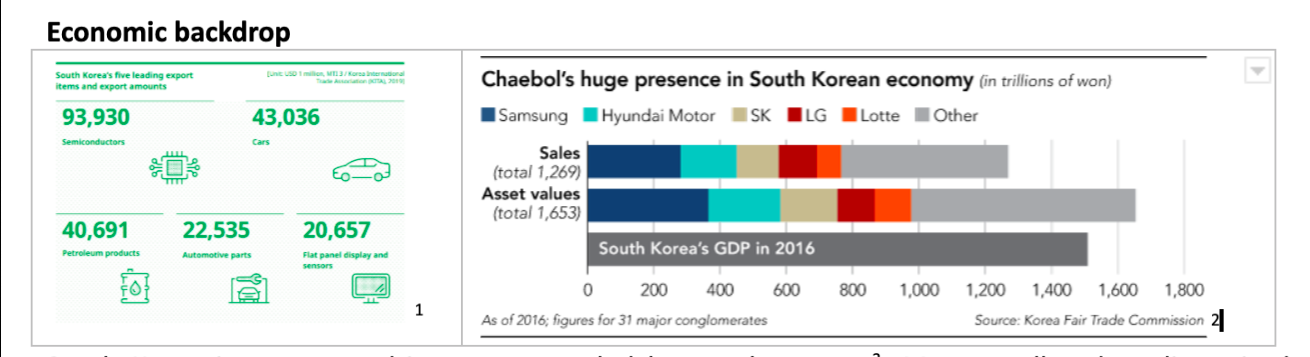

South Korea is an export-driven economy led by conglomerates. Many small and medium-sized companies provide the supply chain components for the major conglomerates. Their products and services have a global reach across many sectors. Korea’s business is particularly well represented in petrochemicals, oil refining and steel manufacturing, and industries it supports, such as clothing, cars, ships, and electronic products. Much of the growth in these sectors is underpinned by fossil fuel resources. It follows conservative linear business models where materials are imported from offshore and converted to products in Korea. This results in Korea having to account for very high emissions.

On the back of this economic growth, Korea has seen a rise in GDP and a wealth increased interest in well-being, engaging with the outdoors, pet culture and globalisation. This, in turn, has, more recently, given birth to new consumer segments being influenced by global trends, including ethical consumption, veganism and zero waste.

In line with this shift and with investor interest moving to low carbon, non-fossil fuel resources and sustainability, KRX (Korea Exchange) announced guidance on ESG disclosure for listed companies to induce more active disclosure of the information. NPS (National Pension Service of Korea) also ratified the Principles on Stewardship called “NPS Stewardship Code” and will apply the ESG principles to their investment decisions.

The South Korean government announced the target for carbon neutrality by 2050, as the nation started tackling the challenge of responding to climate change and attaining sustainable growth simultaneously. A more immediate target is reducing its greenhouse gas emissions by 40 per cent from the 2018 levels by 2030. In addition, South Korea has promised to spend 6.7 trillion (USD) under the Green New Deal, which aims to help the nation’s economy recover from the COVID-19 pandemic by increasing investments in renewables.

This is an ambitious commitment considering where South Korea is now. For example, renewable energy was just 6.5 per cent of total electricity production in 2019 compared to 40 per cent from coal, 26 per cent from LNG and 25 per cent from nuclear.

Against this backdrop, both large and small, Korean companies are under pressure to transition to cleaner, greener businesses as they look to deliver relevant products and services that map to modern consumer lifestyles both at home and globally. This requirement cuts across all sectors, just that each sector faces different kinds of complex challenges. Short term (not always telegraphed) regulatory requirements can be expected too.

What actions can we see?

Companies are increasingly implementing Supplier Code of Conduct using voluntary requirements and certification schemes including EICC (Electronic Sector), SA 8000 (Social Audit), FSC (Forest Stewardship Council), ISO Standards (Environment, Health & Safety, Information Security, Business Continuity etc.), B Corp, Carbon Trust etc.

The growing profile of the ESG and non-financial disclosure cover lifecycle impact of products and services and their supply chain: 78 per cent of the 100 largest companies (by revenue) produced sustainability reports, up from 73 per cent in 2017.

Led by large corporations, some significant steps are already being taken. Discussions in hydrogen technologies among big companies continue to progress rapidly while Hyundai Motor’s Xcient hydrogen-electric trucks have been exported to Switzerland. SK Engineering & Construction changed its name to SK Ecoplant in 2021, reflecting its will to transform its business portfolio from conventional construction to environment-friendly projects such as waste management facilities. Global battery manufacturers LG Electronics and GS Caltex announced their collaboration on electric vehicle charging stations. LG Chem is researching options for utilising carbon from industries’ CCU facilities. The leading corporation of K-cosmetic, Amore Pacific, has picked up the refill trend quickly and new recycling projects for post-consumer packaging.

Despite the efforts being made by both large and small enterprises, even more rapid change will be required, with large corporations expected to take the lead. Many of the larger corporations have significant in-house R&D, but there are limitations on required innovation from this in-house capability. The new approach and solutions required from original supply chain partners show significant opportunities for overseas companies that can present turnkey solutions collaboration opportunities in this space.

There are technology and human resources in Korea for tackling sustainability challenges without a doubt; however, it is about the timing of the demand – whether any foreign company is ready for a certain solution when Korean conglomerates need a quick adaptation.

Examples of foreign companies already exploiting this opportunity include US-based upcycling campaign firm, Terracycle. They have secured contracts for their ‘plug-in’ recycling campaign in Korea with the likes of P&G, Emart, Brita, and Amore Pacific, for the solutions that no Korean provider has been able to offer. New Zealand’s self-driving shuttle bus vehicle producer, Ohmio Automation, has supplied their vehicles for Lotte Corporation, which are now trialling in Sejong City where many Korean government offices are based.

What approach could resonate with Korean companies?

Smaller overseas entities might perceive entering into agreements with large corporations as an uneven playing field. This should not be the case for the right solution that speaks to a key pain point and is supported by a respectable use case. There is the opportunity to be an equal part of the solution for the ‘solution designer’ – in this case, the Korean corporate.

Opportunities also exist to partner with Korean SMEs or start-ups who can become your entry point into a larger corporation. Significant government focus is centred around growing the start-up/entrepreneur space.

The Korean government established nineteen local Centers of Creative Economy and Innovation in 2014, from which the Korean start-up ecosystem often grows. Since the centres are paired with conglomerates and backed by local government obligations, this can be a channel for accelerated commercialisation in the Korean market for foreign companies’ partnerships with Korea.

In summary

South Korea offers a unique opportunity for sustainable solutions that can fill the current supply chain gap where advanced or turnkey options do not exist. Many such opportunities exist across all sectors of the economy, including hi-tech, energy, F&B, construction and others.

Inroads can be made irrespective of the scale of the solution, provided it is proven, with both SME / start-up or large corporate partners by framing up your offer to map to the identified pain point.

Take the first step to map your strengths to these pain points, and you will open the door to some exciting opportunities.

¹ Korea Information – Economy — Korean Cultural Center New York (koreanculture.org)

² South Korea’s Moon vows to rev up jobs and rein in ‘chaebol’ – Nikkei Asia

NO COMMENT