- People’s Bank of China’s state-backed digital currency aims to replace cash circulation (referred to as M0) in its entirety. China´s Digital Currency Electronic Payment (DCEP) is already in an early testing phase with government employees in Shenzhen, Suzhou, Chengdu and Xiong’an.

- DCEP has many advantages. Transactions being visible to the People’s Bank of China (PBoC) will make it easier for the government to combat money laundering and financing of criminal activities. It will also enable the PBoC to better control and manage the total amount of money in circulation and give them real-time insight into the workings of the economy.

- The most apparent advantage of having DCEP is that costs associated with M0 will be done away with. According to one report, the handling charges of paper money eat up 1% to 2% of GDP.

Payment with physical cash is an increasingly rare occurrence in China and almost completely absent from any of its major cities. The country boasted no less than 621 million mobile pay users in 2019 and is well on its way towards becoming a cashless society. China is leading the world in the adoption of e-payments, not only topping the markets of the US, Japan, the UK and Germany, but surpassing all of them combined[1]. Recent efforts of the People’s Bank of China (PBoC), China’s Central Bank, to develop a state-backed digital currency can be seen as another step away from paper money with the eventual goal of replacing cash circulation (referred to as M0) in its entirety.

Launched in 2014 and sped up after the announcement of Facebook´s Libra in 2019, China´s Digital Currency Electronic Payment (DCEP) is already in an early testing phase with government employees in Shenzhen, Suzhou, Chengdu and Xiong’an reportedly receiving DCEP as part of their compensation[2]. According to most recent reports, it will be tested in three new regions, including the Beijing-Tianjin-Hebei region[3]. In April, Starbucks, McDonald’s, Subway as well as 16 other retail firms have been named to be the first to test the digital Yuan[4]. While there isn’t an announcement as to when DCEP will officially be launched, extending DCEP to private companies rather than just government actors is a clear sign that the PBoC is serious about ramping up and expanding testing.

A screenshot showing an online wallet to test DCEP

Source: https://www.ledgerinsights.com/china-digital-currency-wallet-dcep-cbdc/

Now what exactly is DCEP? Even though not all details have been disclosed yet – especially when it comes to the technological basis for the digital currency – we already have an approximate idea of what DCEP will be like. To put it in the simplest terms, DCEP is a digital version of the Chinese Yuan in circulation today. Just like its physical version (or M0) DCEP is 100% state-backed by the government’s reserve fund and every merchant will be legally required to accept it[5].

An interesting feature of DCEP is its offline capability[6]. Money transfers can reportedly be conducted from phone to phone even without internet connection (think of payments in remote areas, while on an airplane etc.). DCEP will thus be a true alternative for M0 and be able to replace coins and banknotes in every conceivable scenario. Moreover, and just like with physical money, DCEP can be transferred between users even when their respective digital wallets aren’t associated with a bank account. This is in contrast to electronic payments via WeChat Pay or Alipay which require money to travel back and forth between existing bank accounts.

Having said that, DCEP does not aim at replacing banks or disrupting China’s financial system in too radical a manner. It will be distributed rather traditionally with the People’s Bank of China issuing the currency to banks and other commercial agencies[7]. These entities, in turn, are tasked with distributing DCEP to the public. Thus, while banks won’t be needed in the transaction of DCEP, they will play a decisive role in spreading the digital Yuan.

The technological basis for DCEP will probably not rely on blockchain technology per se but use some modified form of distributed ledger technology (or DLT)[8]. While blockchains are a specific subtype of DLT, not all distributed ledgers are blockchain technology[9]. Rather, DLT is an umbrella term describing a variety of systems using a consensus of replicated, shared and synchronised digital data. It refers to equally privileged devices that share data and resources amongst each other, i.e. a peer-to-peer network. Importantly, peer-to-peer networks powered by DLT do not have to rely on a centralised administrative device or database to process transactions.

Within this network of devices a consensus algorithm ensures that changes in one device are replicated across all devices; consequently, all devices update themselves with identical copies of the so-called ledger (a data set containing information about all transactions). Different subtypes of distributed ledger technologies differ in the way their consensus algorithms work, with Bitcoin for instance relying on a Proof-of-Work mechanism.

In contrast to cryptocurrencies such as Bitcoin and Ethereum, DCEP will not be based on a decentralised network; instead it will be run on a centralised private network; moreover, unlike those widely popular cryptocurrencies, it will be linked to the personal identity of users, thus not offering anonymity either[10]. DCEP will be programmable money with the PBoC having control over it and being able to trace all transactions within the network.

Lets take a look at the advantages of DCEP. Transactions being visible to the People’s Bank of China will make it easier for the government to combat money laundering and financing of criminal activities, since in a fully transparent system these transactions will have a hard time hiding from the authority’s eyes. It will also enable the PBoC to better control and manage the total amount of money in circulation and give them real-time insight into the workings of the economy.

A unique feature of DCEP is its programmable nature. It is possible to add any function to DCEP to make it more task-specific than traditional money. Government handouts, for instance, could be turned into “digital coupons”. Recipients would then be able to spend DCEP in a specific way, e.g. to continue paying their employees, but not in other ways, e.g. to buy back stocks[11]. Likewise DCEP could be modified to leverage smart contracts, track charity donations, etc.

The most apparent advantage of having DCEP (granted that it will replace physical cash to a significant extent) is that costs associated with M0 will be done away with. According to one report, the handling charges of paper money eat up 1% to 2% of GDP[12]. Introducing DCEP would thus lead to significant savings to say nothing of the downsides of paper money (viral transmission) in a pandemic. Moreover, losing money wouldn’t be possible anymore since the digital wallet would be safely secured in the system.

More importantly, not having to rely on financial intermediaries, gets around transaction fees and allows for faster transactions[13]. The fact that no bank account will be required for the use of DCEP will make it possible for unbanked people to use digital DCEP wallets as well[14]. This is of particular importance in China, which has the world’s largest unbanked population with an estimated 225 million people having no access to a bank account of their own[15]. Being able to support unbanked people will also significantly increase the potential user base beyond China.

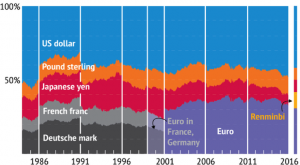

A graph illustrating the relative prevalence of different currencies

Source: International Monetary Fund

Considering that China has, according to some measures, already overtaken the US economically, the RMB (Renminbi) certainly has the potential to become a much more internationally important currency. A digital version capable of fast and free cross-border transactions will be a big step in that direction. The fact that it will be one of the very first such currencies and thus encounter little competition in the digital realm is likely to further boost its adoption rate. Moreover, DCEP will decrease China’s dependency on S.W.I.F.T. which nowadays facilitates most cross-border payments.

Riya Kaif

18 March

Insightful article. Looking forward to read more.